Day Trading Volume Profile Course – Price Action Volume Trader

$225.00 Original price was: $225.00.$24.50Current price is: $24.50.

- Delivery: You Will Receive A Receipt With Download Link Through Email.

- If you need more proof ofcourse, feel free to chat with me!

Description

Table of Contents

TogglePrice Action Volume Trader – Day Trading With Volume Profile & Orderflow.

Unlock Intraday Profits- A Deep Dive into Volume Profile Trading Course. This article provides a comprehensive look at what a Volume Profile Course entails, exploring how it can supercharge intraday trading strategies by combining nuanced analysis of order flow and price action. In this deep dive into the mechanics and philosophy of high-frequency trading, we look at the core concepts, strategies, and tools involved.

Volume Profile Course

The appeal of day trading, particularly in the volatile world of futures markets, lies in the potential for rapid, significant returns. However, realizing this potential demands a sophisticated approach, one that moves beyond simple technical indicators and embraces a deeper understanding of market dynamics. This is where a focused volume profile course comes into play. It’s not just about identifying chart patterns, or relying solely on indicators; it offers a framework to interpret real-time market data, specifically through the lens of volume. Such a course aims to transform the trader from reactive participant to proactive strategist, equipped with tools to see beneath the surface of price movements.

The Core of Volume Profile Analysis

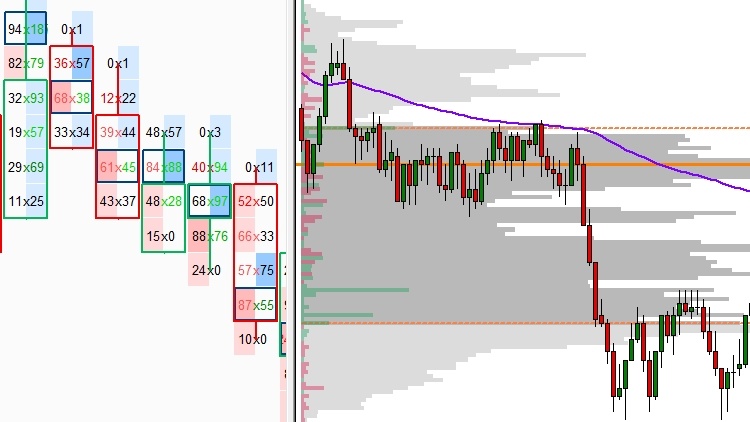

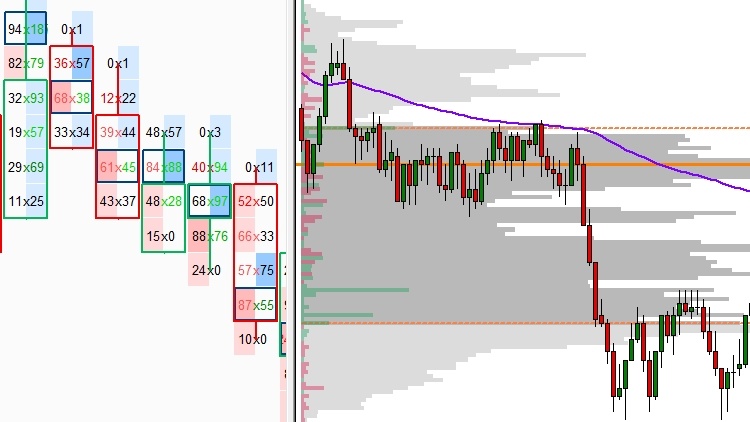

At the heart of a robust Volume Profile Course is understanding what the tool represents and how it displays in the overall market context. Simply put, Volume Profile visualizes how much volume has been traded around different price levels. This visual representation creates a distinct, sideways bar graph on a chart, creating a “profile.” This is not the same as market volume at any specific point, but volume at price on the chart, and the visual “profile” is what is being analyzed. This isn’t just a static snapshot but a dynamic and ever-changing portrayal of market activity. The structure itself contains key elements; a high-volume node (HVN) where significant trading has taken place, and low-volume nodes (LVN) where there’s been relatively little interaction. Recognizing these and understanding how they shift and evolve is fundamental to profiting alongside this information.

Thinking deeper, the Volume Profile becomes a map of price acceptance and resistance. The price points where we see high trading volume can be viewed as areas where the market finds value. These areas often act as magnets, drawing price action and becoming levels of support or resistance to the price. Low volume price areas, on the other hand, indicate areas where price is less likely to be defended by either buyers or sellers. This gives a sense of where price might accelerate or decelerate. A volume profile course should teach you to utilize these areas, and how to build trading strategies using them to determine likely price action based on key areas of volume on your charts. It’s about seeing the market not as a chaotic entity but rather as an entity following a dynamic structure that can be interpreted. The ability to view a market this way is crucial, and takes significant time studying to recognize in real time, but the tools provided make the process much easier.

Integrating Orderflow in a Volume Profile Course

Of all aspects taught, the true game-changer is the integration of volume profile with order flow. Order flow refers to the stream of bids and asks that drive market prices, and with order flow we can see market action evolve in real time, or at least what has happened at any specific point on time on the chart. When combined with the visual insights from the volume profile course, real time data analysis of markets becomes much easier and more intuitive. The course should delve into components such as tick data, delta, and footprint charts. Delta, for instance, shows the difference between buying and selling volume, giving clues on if the buyers or sellers are dominating the market. Footprint charts provide a granular view of order flow at each price level, offering insights that traditional candle sticks obscure, and finally, a good foundation in tick charts makes you aware of transaction based movements, not those based on time.

Integrating order flow is akin to seeing the market’s inner workings. It allows the trader to see when the market’s dynamics are about to shift, or about to continue. For instance, a high volume node with a large buying delta might signal strong demand, indicating a potential upwards price move. Conversely, a high volume node with a large selling delta implies intense selling pressure, which could lead to a downward move. By studying this real time action the volume profile course can put you on track to be well informed of where the market might be heading. This interplay between volume and order flow tools is the heartbeat of any effective high-frequency strategy. The tools themselves are valuable alone, but the real skill comes in learning how to analyze them correctly with a combination of all the indicators provided. The best way to learn this is through practice, and in real time markets, utilizing the strategies of the course to determine key price action.

Practical Application and Software Agnostic Approach

Beyond theory, the effectiveness of a volume profile course lies in its practicality. Most incorporate real-world examples, practical usage of the tools, and a clear methodology to follow in the markets. A key component of this is the software, with most courses using Sierra Charts as the main tool used. However, a practical course teaches the principles in a software agnostic manner. Meaning that while Sierra Charts may be the main program, the core concepts can be applied to any platform that provides the tools mentioned, with the only limits being the user and the platform’s ability to provide the indicators. The goal is not to be reliant on a specific software, but on the principals being taught within the course.

The software aspects and integration into each platform becomes a personal journey, based on the tools, interfaces and availability of the indicators discussed in the volume profile course. A good volume profile course will provide support for the core concepts, and assist with setting up platforms to replicate the tools and strategies. The goal is still to understand the basics, regardless of the specific ways we visually display them in the charts. Overall, the core principals are still in place, and understanding the concepts is what makes or breaks most traders implementing this information. So while software is necessary for charts, the principles are universal. A well rounded approach to each software will be the best way to succeed moving forward, as each platform provides its unique aspects, and a variety of different ways to utilize core concepts discussed in the course.

Types of opens in futures order flow

Understanding the types of opens in futures order flow is pivotal for any serious intraday trader. The opening of any market session isn’t just a static event it’s a moment of potential that sets the tone for the day of trading. How the market opens can provide crucial information about the underlying sentiment, and how to strategize for the timeframes ahead in real time. Analyzing various aspects of the open, including, volatility, volume, order flow, and price action can give you considerable edge if interpreted correctly, compared to a trader who did not consider them. An open is never the same as the last; a market can open with a multitude of different scenarios, which should be noted during your trading.

The Significance of Opening Auction

The opening auction, often a short time period before the official open begins, is a critical phase that is often overlooked and under-utilized. During this period, orders start to fill, volumes start to ramp up, and the first movements of price become visible. This is an initial indication of where the market intends to move for the day, with the early data offering key insights. A volume profile course should teach to identify these situations, and how to use them to the advantage. Specifically, the price and order movement in the auction period will almost always dictate how price might move in the first few minutes of the new session.

Thinking about the auction itself, it is akin to a pre-game show. It’s where early participants stake their claim and express their conviction through aggressive or passive bids, and offers in the order book. High volume in the opening pre-auction, generally means the market is preparing for a high opportunity session. Often this will result in an explosion of price volatility in the first few minutes of opening, as players attempt to push price in the direction they are positioned. Conversely, a quieter pre-auction, at the open, generally implies that there is less conviction in the market at the beginning, and a more subdued price action can be expected. Having the information in the opening auction, helps set the tone for the trading day ahead, and utilizing this data can improve trading opportunities compared to just looking at a simple opening price.

Gap Opens and Their Implications

One of the most powerful open types, are gap opens, which are often viewed as a good opportunity, but are also associated with high risk. A gap open occurs when there is a clear difference between an assets’ closing price the previous day, and its opening price the next, showing on the chart as a “gap” where price has not moved. These gaps can result from a variety of things – overnight news, earnings updates, or even just a lack of participants overnight, and are common especially overnight in volatile market conditions. Types of opens in futures order flow must include an awareness of varying kinds of gap types to understand the implications.

When a gap happens, it doesn’t just leave a void on the price charts; it leaves an imbalance which the market often strives to resolve, or at least retest at some point on the day. A gap up (where today’s price begins higher than the previous close) can indicate strong positive sentiment, while a gap down (where today’s price opens lower than yesterday’s close) might suggest bearishness. In a volume profile strategy, gaps can often times act as support or resistance, and a gap might be “filled” as the price returns to the level where price has not traded. In general gap fills are seen as good trading opportunities, but with enough studying on the indicators discussed earlier in this article, you can often determine whether the gap will fill or not based on real time order flow. When you understand that gaps create natural interest in the market, and can be used as key indications of market movement, utilizing gaps effectively can be beneficial to your trading.

Identifying Market Sentiment

Ultimately, each open type in order flow can be viewed as a key sign of the overall market sentiment. For example, an opening high that is met with aggressive selling may signal a change in trend. Conversely, an opening at or near the previous day’s close can signify stability without a clear directional bias, or simply a lack of the market’s conviction to move price in a particular direction. The key here is to combine data, not utilize it in just one tool at a time. The importance cannot be understated enough when it comes to viewing multiple data points in tandem. Most of the time, relying on only one indicator, without comparing that indicator to other relevant signals might cost you trading opportunities, or potential losses in trades going in the wrong direction.

A volume profile course emphasizes the importance of real time assessment and how to combine multiple signals together. For instance if the market shows a strong price open, with large volume, a large buying orderflow, and a move above a key resistance level, this might mean that price will continue its move higher. However, if the market gaps to the upside, with low opening volume, low delta and a move back into the prior day’s range, this could mean that the market is about to move lower, and the gap is likely to be filled. Such combinations of these market indicators, paints a very clear picture for the day, and all it takes to view these is practice, combining these multiple factors into a unified strategy. Analyzing the open goes beyond just recognizing patterns and requires an attentive blend of price action, volume, order flow, and overall market data. It’s a skill that helps anticipate market movements and better inform a trader’s day strategy.

Volume profile strategy

A volume profile strategy serves as the backbone for most high frequency traders utilizing a volume-centric approach. This strategy is not a formula to make money, but an outlook and approach based on data analysis, and must incorporate a complete understanding of the market’s structural data. This data will allow you to see where price is more likely to move and react, based on points of high and low volume. This is vastly different from price-action only techniques, as it offers a more in-depth perspective of how price itself moves, and not just where price has been or is about to be, via price-action analysis. The real power comes in combining the two.

Establishing Trading Zones

One key aspect of a good volume profile strategy is the identification of areas with significant trading activity. The volume profile highlights these zones by displaying volume in a way that makes it easy to see the points with the most trading, and those with the least. These “nodes” are the basis for most strategies, as they present areas where the market has spent time in a previous period, and is more likely to return to at some point. Zones of high volume, or the high volume nodes (HVN), often offer support or resistance to price movement in the near term, while low volume nodes (LVN) show areas where the price experiences less reaction and are usually areas that can accelerate price faster if broken.

When establishing these zones, it is crucial to understand they are not static lines on a chart. Instead, they are dynamic regions where the market may slow down, speed up, or reverse course. A volume profile strategy often requires using these nodes as reference points to determine trading opportunities. For example, consider a price that has moved away from an HVN. A trader might watch for a return to this zone as a buying or selling opportunity, or an area to secure profits on trades which are currently successful. Conversely, observing a price move quickly through an LVN, means that the area has little value to the market, and can be used as an indicator that price will continue its move in the direction it is already moving in. Zones are not permanent, and they can shift and change based on how the market interacts with them in real time, which is important to remember.

Combining Volume with Price Action

Although volume is the main focus in a volume profile strategy, combining it with price action techniques creates a more advanced strategy. This means looking at traditional technical analysis, in addition to a volume strategy to get a fuller understanding of what is happening in a market. A trader might analyze candlestick patterns with volume profile to confirm potential trade set ups. For example a breakout of a key support level, in combination with heavy order flow at the high volume area might signal the a trade set up, and price can be expected to continue below that key level. Similarly, a clear price rejection below this level might mean that the break was false, and signals that the price is likely to move in the opposite direction.

The integration of price action with a volume profile isn’t just about finding isolated price patterns, its about confirming them. When patterns are confirmed via a combination of both strategies this creates better trading conditions and higher probability setups for the trader. For instance, when a trend line break is paired with a high volume zone, you get additional conviction that the market is likely to move in the direction the trade is indicating. By combining the two strategies, traders can gain a higher level of confidence, with a better understanding of what is moving the price, and why it is reacting in a certain way in real-time scenarios. This is a key skill to master.

Identifying Breakouts, Breakdowns and Failed Reactions

Breakouts and false breaks, offer specific opportunities within a volume profile strategy. A breakout is defined when the price breaks through a level (determined by volume or price action) on higher order flow volumes, signaling that the move is likely to carry on to the next level. A breakdown is similar, except the price will break below a determined area on high volume order flow. A false break is when the price does not carry on in direction, and price is often pushed to the opposite side of the level. The failure of these moves gives key trade clues, since the price will often move in the opposite direction.

When a price breaks out or down on heavy volume, especially from the high area node, this is frequently an indicator that a new zone may be established, giving the traders key areas to consider for trades in the near future. The false break, especially when it is reabsorbed into a key volume area, is often followed by an opposite directional move, creating excellent trading scenarios in real time. To make it concise, you are trading based on the market’s reaction to zones, and the inability of a move to follow through after those reactions. These high probability setups are ideal areas of practice for new traders, as they tend to follow certain general rules that can often act as a guide in volatile market conditions. A well formed technique should prepare traders to understand these dynamic market types.

Conclusion

In summary, a deep dive into a volume profile course offers a perspective beyond basic indicator tools and market analysis methods. It allows the trader to go beyond traditional analysis, by observing a real time picture of market dynamics with the help of visual indicators. By integrating types of opens in futures order flow with a dynamic volume profile strategy, the course equips traders with the methods to read and react to market behaviors, and real time data in ways that were previously impossible. This unique approach to the market, provides a more insightful approach than can be had with techniques based around price movement alone. Ultimately, trading is about reacting to the market, and with the strategies and tools offered in the course, traders are offered a methodology to do exactly this in the most effective manner possible.

Related products

-

Sale!

Ninjatrader Automated Trading Systems – NinjaTrader 8 Algo Bot – Trading123

$3,595.00Original price was: $3,595.00.$35.00Current price is: $35.00. -

Sale!

TradingView Pine Script 102 – The Complete Strategy Guide

$97.00Original price was: $97.00.$22.00Current price is: $22.00. -

Sale!

Trading NFX Course – Andrew NFX

$500.00Original price was: $500.00.$15.00Current price is: $15.00. -

Trader Dante – Edges for Ledges 2024

$32.00

Reviews

There are no reviews yet.